When you apply to rent an apartment the landlord or property manager may do a credit check as part of your application review. A hard check happens when someone pulls your credit report because youre applying for credit with them.

The Difference Between Hard And Soft Credit Checks

The Difference Between Hard And Soft Credit Checks

apartment credit check soft inquiry

apartment credit check soft inquiry is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in apartment credit check soft inquiry content depends on the source site. We hope you do not use it for commercial purposes.

A single apartment credit check is considered a hard inquiry and therefore dings your score about five to 10 points.

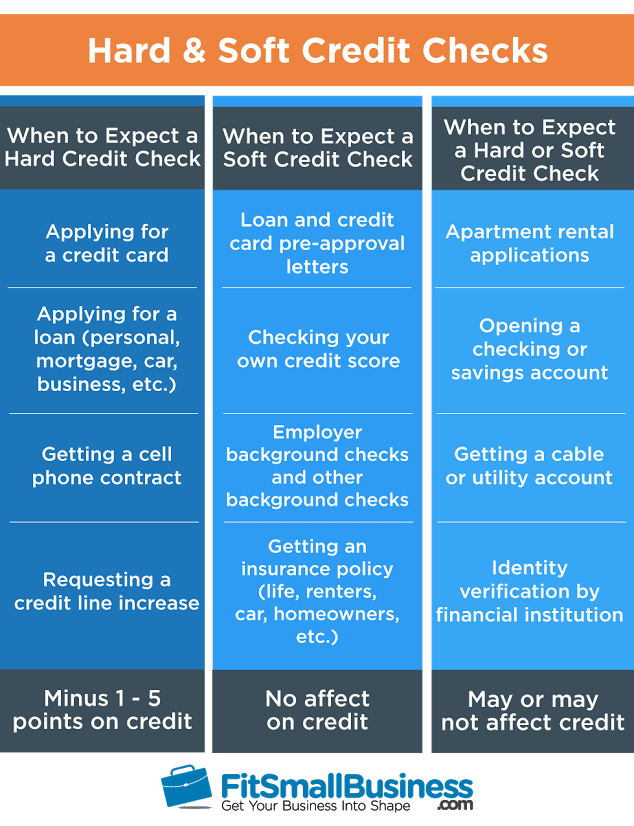

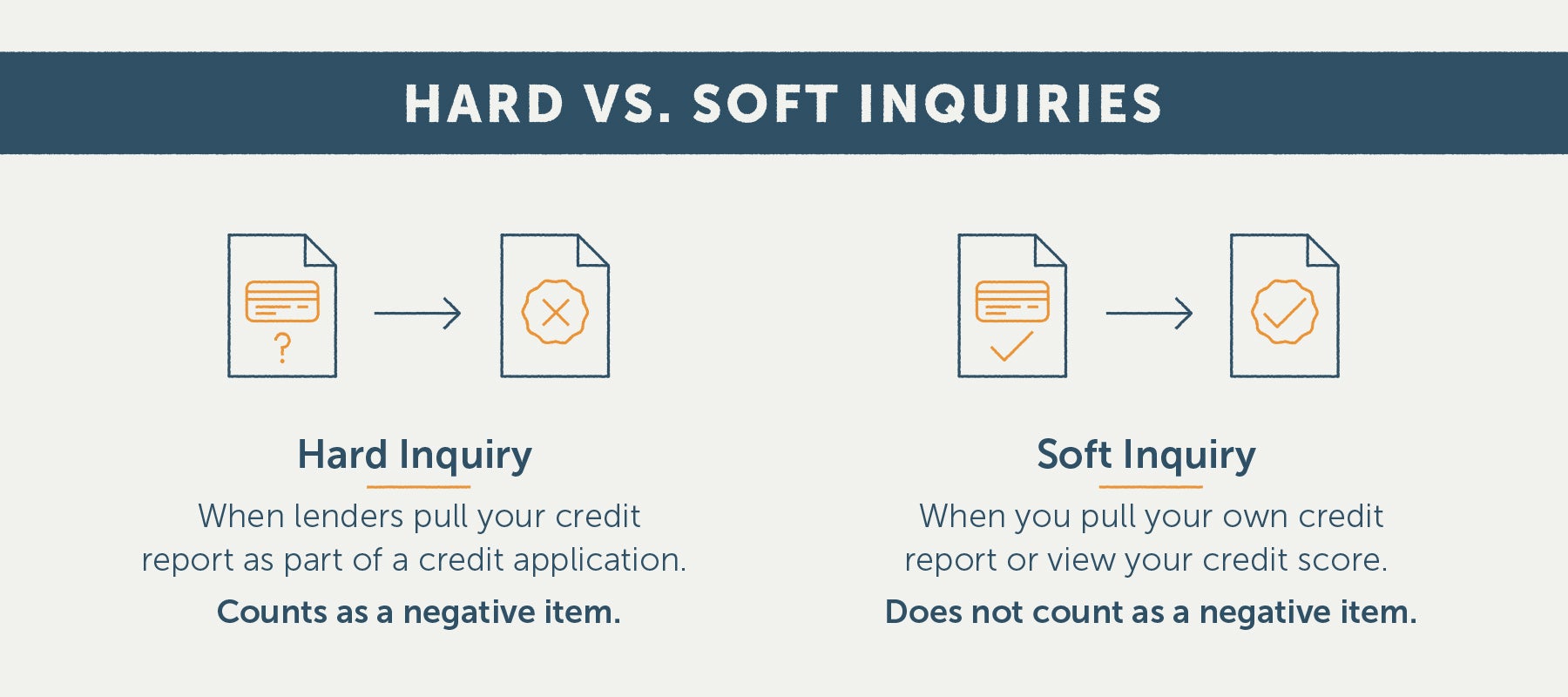

Apartment credit check soft inquiry. Think of soft credit inquiries as a quick reference for property managers. They can also happen when a company such as a credit card issuer or mortgage lender checks your credit to preapprove you for an offer. Notice how rental property applications appear under both categories.

It should not affect your fico score at all. A hard inquiry usually takes about five points off. If you did it may be reported as a hard inquiry.

If you didnt it should be reported as a soft inquiry. Because you initiate the check it counts as a soft inquiry and doesnt negatively affect your credit. Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports.

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. You can reduce the affect that apartment hunting has on your credit score by. If they request a soft inquiry as is the case with pre approved credit cards and other self initiated credit report pulls like with credit karma it will not affect your credit score.

In this case the credit reporting agency will note the check on your credit report. When you undergo a credit check for a potential apartment. Credit card or mortgage companies that you already conduct business with may sometimes check in on your credit and lending behavior through soft inquiries.

What kind of inquiry should i expect from apartment rental credit checks. This kind of credit check is also referred to as a soft credit pull and is often associated with apartment applicants that are getting pre approved for the rental. The only result is that this request will show up on your credit history.

Thats because the same rental application can lead to either a hard or soft inquiry largely depending on how the credit information is accessed from the credit bureau. A soft check is a request to pull your credit report for viewing. This is similar to the way a landlord will drive by his or her property just to check on it but not go inside the.

The impact of these credit inquiries on your credit score will depend on how each apartment owner will generate the credit check. The landlord typically conducts a hard pull or inquiry. The consumer is not the only entity able to perform a soft inquiry.

A soft inquiry sometimes known as a soft credit check or soft credit pull happens when you or someone you authorize like a potential employer checks your credit report. Unlike a hard credit inquiry a soft credit inquiry wont affect your fico score.

What Is A Soft Inquiry Experian

What Is A Soft Inquiry Experian

Hard Vs Soft Credit Checks Their Affect On Credit Scores

Hard Vs Soft Credit Checks Their Affect On Credit Scores

Hard Vs Soft Credit Inquiries How Property Managers Check Credit

Hard Vs Soft Credit Inquiries How Property Managers Check Credit

The Difference Between Hard And Soft Credit Checks

The Difference Between Hard And Soft Credit Checks

How To Remove Inquiries From A Credit Report Lexington Law

How To Remove Inquiries From A Credit Report Lexington Law

What Is A Soft Credit Check Credit Com

What Is A Soft Credit Check Credit Com

Hard Credit Inquiries Vs Soft Credit Inquiries In Apartment

Hard Credit Inquiries Vs Soft Credit Inquiries In Apartment

Are Apartment Application Credit Checks Hard Or Soft Inquiries

Are Apartment Application Credit Checks Hard Or Soft Inquiries

The Apartment Credit Check Hard Or Soft Apartmentsearch

How To Remove Credit Inquiries From Credit Reports Letter Template

How To Remove Credit Inquiries From Credit Reports Letter Template

/gettyimages-157681670-2048x2048-c9b9865117444bf3b61298f1834c9f8e.jpg)